Want to learn to trade cryptocurrencies in the USA but don't know where to start? This ultimate US guide teaches you everything you need to know about crypto trading and review the best crypto broker in the USA.

When the world was exposed to the first-ever cryptocurrency Bitcoin, no one could have envisaged the introduction of a further 6,000+ coins in the 10 years that followed. Fast forward to 2020 and cryptocurrency trading in the USA has never been more popular.

Some of the most traded digital currencies in the space are Ethereum, Litecoin, Ripple, and of course - Bitcoin. Cryptocurrency trading involves two digital coins being traded against each other, much like the forex market.

The lion's share of crypto traders in the USA will trade pairs like BTC/USD. This means that you are attempting to speculate whether the value of Bitcoin will rise or fall against the US dollar.

With that said, cryptocurrency trading is not an easy battleground to master. After all, you will be risking your own money - meaning that you need to have an understanding of how the markets work.

Taking this into account, this Cryptocurrency Trading USA Guide will tell you everything you need to know. Once we cover the basics of what cryptocurrency trading is and how it works in the US, we’ll then explain the ins and outs of market orders, risk management, strategies, profit-making ideas, and how to get started today.

Contents

What is Cryptocurrency Trading USA?

How Does Cryptocurrency Trading Work in the USA?

Cryptocurrency Trading USA: Trading Orders

Which Cryptocurrencies Can I Trade in the USA?

Making a Profit When Trading Cryptocurrency in the USA

Cryptocurrency Trading USA: Tried and True Strategies

Cryptocurrency Trading USA: The Pros and Cons

Cryptocurrency Trading USA: Broker Fees to Expect

Cryptocurrency Trading USA: Signals and Software

Cryptocurrency Trading USA: Trading Tips

Cryptocurrency Trading USA: How to Sign Up With a Broker

Cryptocurrency Trading USA: Final Thoughts

What are Cryptocurrencies?

Fundamentally, cryptocurrencies are virtual coins which can be traded, exchanged and transferred digitally. Many crypto-assets are backed by decentralized networks, meaning for the most part, have been designed using digital files and blockchain tech.

Cryptocurrencies are not a ‘fiat’ currency. This means that they are not backed by big central banks, nor are they printed by the government. This is largely why crypto-assets are traded against a recognisable currency such as the US dollar, Australian dollar, and British pound.

Virtual currencies are not physical coins or notes. As such, they can be stored in what's known as a ‘digital wallet’. It’s nothing new to keep things online - most of us utilise clouds to store our photographs and such like.

When it comes to crypto wallets, you receive your own ‘address’ or ‘public key’. This enables you to receive cryptocurrencies from other users. You are also given a ‘private key’, which is comparable to your traditional online bank account password, albeit much longer. The aforementioned private key gives you access to your own wallet.

Hopefully, this has helped clear the mist on what cryptocurrencies are. Next, we are going to guide you through how to trade these digital tokens.

What is Cryptocurrency Trading USA?

Irrelevant to which asset you are trading, in this case, cryptocurrencies - you need to buy and sell with the hope of making a profit.

Although it’s not as cut and dry as that, your goal as a trader is to decide on a crypto pair, and then try to correctly speculate on the value of that pair rising or falling. By correctly timing the market you can make some generous gains.

Now that you get the gist, let’s look at an example of how cryptocurrency trading in the USA works:

- Let’s imagine your pair of choice is Ripple XRP/USD

- In this scenario, you are trading Ripple against the US dollar

- Your broker has quoted XRP/USD at $0.38

- You think the pair is undervalued so place a $1,000 buy order

- A few hours later the pair is quoted at $0.40

- The value of XRP/USD went up by 5.26%

- You place a sell order with your broker to lock in your gains

- From your initial stake of $1,000 on this cryptocurrency trade - your profit is $52.60 ($1,000 x 5.26%)

As you can see, there is an obvious likeness between forex trading and cryptocurrency trading - in that you are trading two currencies against one another. In both trading markets, supply and demand play an important role in the going price of an asset - therefore, the price shifts and changes throughout each and every trading day.

Just about any Joe Schmoe with access to the internet can trade cryptocurrencies in this day and age. In fact, it has never been easier.

Interestingly, many cryptocurrency traders outside of the US tend to trade digital coins via CFDs (Contracts-for-Differences) - enabling them to trade using leverage. However, these contracts are not available to clients in the US, so you will find it difficult to gain access to leverage.

That said, there are a few crypto derivative platforms where you will be offered leverage of up to 1:100 (meaning a $10 stake becomes $1,000). Even so, we strongly advise against being tempted by these trading platforms. After all, they will almost certainly be unlicensed platforms. As such, you will not be protected by any regulatory bodies.

Please note: Trading CFDs are not permitted in the USA

Fancy trading digital currencies yourself but don’t know where to start? Stay right where you are. There are a few more things to cover in order to help you on your way with your new crypto trading career.

How Does Cryptocurrency Trading Work in the USA?

So, now you know what cryptocurrencies are, and the basics of how to trade them, we can go into a little more detail.

As we said, the basis of trading digital coins is to try and guess which way the price of your chosen pair will go - and to then place an appropriate order. However, as any experienced cryptocurrency trader in the USA will tell you - it’s not just a guessing game. If you go into trading any asset blindly - you could lose everything you have.

For this reason, it is strongly advised that you educate yourself on how the cryptocurrency trading market works and utilise the various orders available, which in turn can help you mitigate risk. We are going to cover orders in more detail further down this page.

Not only is understanding the importance of bankroll management crucial - but tools, charts and analysis as also an integral part of cryptocurrency trading in the USA. Again, don’t fret - we are going to divulge some of the best tools and strategies which will be useful when trading your asset of choice shortly.

Cryptocurrency Pair Types

When you are reading about cryptocurrencies you will notice that they are universally split into two different categories. Those pair categories are crypto-fiat and crypto cross.

Let’s explain each, with practical examples for clarity.

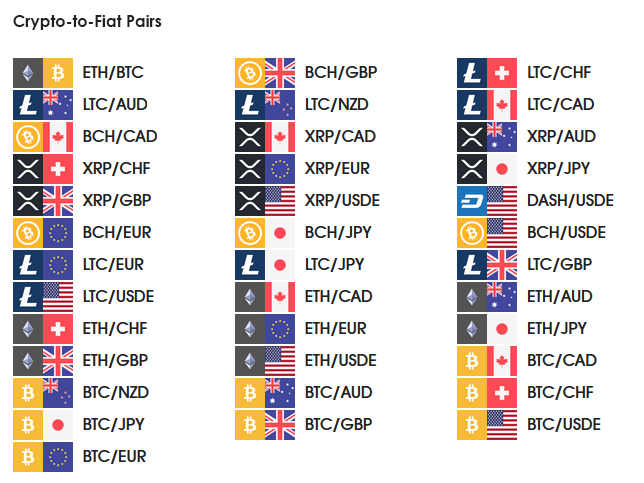

Crypto-to-Fiat Pairs

We touched on ‘fiat’ money earlier. To clarify, this means tangible government-issued currencies - such as the US dollar.

When it comes to a crypto-to-fiat pair, you are trading a digital currency such as Litecoin against a fiat currency. Many people who trade cryptocurrencies prefer to trade this way, rather than crypto cross pairs - which we are going to cover next.

The vast majority of commodities (think gold, oil, soy etc), for instance, are quoted in USD. This makes sense, given that it is the most traded currency in the world. For the same reason, virtual currencies like Bitcoin are often traded against the US dollar also.

Let’s give you a clearer picture of what a crypto-to-fiat trade looks like:

- Let’s hypothesise that you are trading Litecoin against the US dollar

- The pair you are trading is LTC/USD

- The trading platform you are signed up with quotes you $50.50 for the pair

- You have a feeling the price is going to rise

- With this in mind, you open a $500 buy order

- 3 days later LTC/USD is valued at $58.00

- Your prediction was correct - as this shows an increase of 14.85%

- You place a sell order via your broker to close the trade

- The initial $500 stake is now worth $574.25

- Your profit from this trade is $74.25 - minus any broker fees

We used LTC/USD in our above example. However, there are more pairs to choose from.

Please see the below a list of tradable crypto-to-fiat currency pairs for your inspiration - but bear in mind that not all brokers offer access to the same markets:

- BTC/JPY (Bitcoin/Japanese yen)

- ETH/USD (Ethereum/US dollar)

- BTC/AUD (Bitcoin/Australian dollar)

- XRP/USD (Ripple/US dollar)

- LTC/GBP (Litecoin/British pound)

- ETH/AUD (Ethereum/Australian dollar)

- LTC/JPY (Litecoin/Japanese yen)

- XRP/AUD (Ripple/Australian dollar)

- ETH/GBP (Ethereum//British pound)

- TRX/USD (Tron/US dollar)

- And many, many others

Crypto Cross Pairs

Crypto cross pairs are sometimes referred to as crypto-to-crypto. The reason being, you are trading two digital currencies against each other.

In simple terms, you are still trading a ‘base’ currency against a ‘quote’ currency - such as BTC/ETH. In this case, Bitcoin is your base currency, and Ethereum is the quote currency. Once again, this mirrors the core principles of trading forex pairs.

Using the above pair as our example, let's divulge how that trade might play out:

- Your broker has priced BTC/ETH at 35.10

- This illustrates that for every Bitcoin, you get 35.10 Ethereum

- Your aim is to predict whether BTC/ETH will rise above or fall below 35.10

When trading crypto cross pairs it can be difficult to calculate your potential gains and losses. This is due to the lack of a familiar currency value (like the US dollar). If you are new to cryptocurrency trading in the USA, then we highly recommend starting with crypto-to-fiat pairs.

Nevertheless, you will find below some of the crypto cross pairs which might be offered by your broker.

- BTC/XRP

- ETH/BTC

- BTC/LTC

- XRP/BTC

- LTC/ETH

Cryptocurrency Trading USA: Trading Orders

Now that we’ve covered all of the basic elements of cryptocurrency trading in the USA - we should discuss how to place an order. Your order is going to be executed by your broker, but you call the shots - so you’re going to need to know what the order is going to achieve.

To give you a helping hand, we’ve compiled a list of the most useful orders for cryptocurrency traders.

Buy and Sell Orders (Ask / Bid)

Let’s start with the basics - buy and sell orders. These are sometimes called ‘ask’ and ‘bid’, but essentially mean the same thing.

You know from our examples that buy and sell orders are a pivotal part of cryptocurrency trading in the USA. This is how you enter and exit a position in the market. As we’ve said, you need to speculate on the rise or fall of a crypto pair - this is how you make gains (or losses).

In the name of clarity, let’s give you an example of utilising a buy order with your broker:

- Your broker quotes $13,800 on BTC/USD

- You think this pair is going to rise in value

- In this instance, you place a buy order with your broker

Now, here is how a sell order is used:

- Let’s imagine you are trading BTC/USD

- You think the price of the pair is going to fall

- With this in mind, you place a sell order

Limit and Market Orders

In a nutshell, limit orders allow you to enter the market at a specific price. On the other hand, market orders allow you to enter the market at the current (or next available) price.

Let’s give you an example of each order, illustrating when you would use them when trading cryptocurrency pairs online.

Example 1: Utilising a Limit Order

- The cryptocurrency pair you are trading is quoted at $200

- You want to enter the market at $180

- With that in mind, you place a limit order

- If and when the pair drops to $180 - your broker executes your order

Example 2: Utilising a Market Order

- You want your order carried out immediately

- With that in mind, you place a market order

- Your broker executes your order immediately at the next available price

As you can see from our above examples, you are able to set boundaries when it comes to when to enter or exit the market. In terms of limit orders - the position will stay as it is until the predetermined price is struck. In other words, the order will remain pending until your pre-defined price is met by the markets.

Stop-Loss and Take-Profit

When it comes to softening losses and managing risk, stop-loss orders are a very popular way to do this. In terms of locking in a preferred profit percentage, take-profit orders are used. Although neither of these orders are imperative to enter your chosen market, they are extremely useful to crypto traders.

Starting with stop-loss orders, let’s give you a practical example:

- Let’s say you are trading LTC/USD

- You create a $1,000 buy order with your broker

- You’re unwilling to lose more than 5% of your investment

- With that in mind, you action a $950 stop-loss order

- The value of LTC/USD falls by 5%

- Your broker closed your position at $950

As you can see from the above, the most that you could have lost is 5% of the amount staked. When your position hit the 5% figure of $950, your broker automatically closed the trade - subsequently ensuring that no further losses were encountered.

Now let us give you an example of a take-profit order:

- Let’s say you are trading BTC/USD

- You have placed a buy order of $2,000

- On this trade, you want to make a profit of 10%

- Taking that into account - you create a $2,200 take-profit order

- The price of BTC/USD increases by 10% - meaning your $2,000 stake is now worth $2,200

- Your broker will close your trade immediately to lock in your gains

As you can see, stop-loss and take-profit orders are opposites of one another. Using them enables traders to lock in gains, whilst also limiting losses as the value of the pair fluctuates.

Moreover, by having these orders in place, there is no need for you to worry about monitoring the value of a pair throughout - meaning there is no need for you to close the position manually and time the market.

Which Cryptocurrencies Can I Trade in the USA?

To reiterate, there are over 7,000 digital currencies at this time, however not every broker will offer access to the same markets.

With millions of us trading cryptocurrencies on a daily basis, you can be sure to find a cryptocurrency pair you are interested in trading - with a broker you like.

You will find below a list of some of the most popular crypto-assets available to trade in 2021:

- Bitcoin (BTC)

- Ripple (XRP)

- EOS (EOS)

- Binance Coin (BNB)

- Litecoin (LTC)

- Ethereum (ETH)

- Tether (USDT)

- Monero (XMR)

- Bitcoin Cash (BCH)

- Bitcoin SV (BSV)

To get an idea of what each currency is priced at you can perform an internet search, or have a look on the trading platform you are using.

Alternatively, platforms such as CoinMarketCap.com are very popular for checking current prices. All cryptocurrencies are listed by market capitalisation along with prices, charts and historical data. We have a comprehensive list of useful tools further down this page.

Making a Profit When Trading Cryptocurrency in the USA

It is entirely possible to make a profit from cryptocurrency trading in the USA. However, it is not advisable to go in with a ‘gung ho’ approach. Good things come to those who wait, or in this case, those who take the time to learn.

Crypto trading doesn’t come without risk, and a big part of trading this asset is gaining an understanding of the markets. Not to mention honing in on technical analysis and chart reading skills - and following fundamental analysis such as financial and economic news.

Please find below an example of going long and going short on a crypto-asset trade:

Example One: Speculating on a crypto pair price drop - Going Short

- Let’s hypothesise that you are trading ETH/USD

- On Monday you are quoted $440.10 on the pair

- You think the pair will fall in value

- You create a sell order worth $1,000

- By Thursday, ETH/USD is priced at $385.00

- This represents a 12.51% price drop

- You speculated correctly by electing to go short

- Bearing this in mind you place a buy order to close your position

- Your initial $1,000 stake is now $1,125.10

- You made a healthy profit of $125.10 on your ETH/USD trade

In our imaginary scenario, you entered the ETH/USD trade with a sell order, and in order to close your position you created a buy order.

Example Two: Speculating on a crypto pair price rise - Going Long

- Now, let's say you are trading Bitcoin against the Australian dollar

- BTC/AUD is quoted at $20,000

- You think the price of the pair is going to rise

- You create a buy order worth $500

- A mere 3 hours later BTC/AUD is valued at $21,500

- It turns out you predicted correctly - the new price shows an increase of 7.5%

- To cash in your profits you place a sell order

- Your $500 became $537.50

- You made a $37.50 profit on your BTC/AUD trade

In our imaginary scenario, you entered the BTC/AUD trade with a buy order, and in order to close your position you created a sell order.

Cryptocurrency Trading USA: Tried and True Strategies

At this point in our Cryptocurrency Trading USA Guide, we are going to discuss strategies. After all, when reading about the trading of any asset you will see the term ‘trading strategies’ a lot.

Much like with anything, when it comes to parting with money - having a plan or strategy is key to maintaining some control over your finances. In other words, there’s no use praying to the ‘trading gods’ and throwing a load of money at something you don’t fully understand - it’s not likely to end well.

With that in mind, once you have figured out which trading platform you wish to use, you can start thinking about your own strategy. We’ve listed below the most tried and tested strategies used by cryptocurrency traders in the USA.

Crypto Market Corrections

Market corrections are enforced when there is a steep upward or downward trend. These spikes can jeopardise the economy - thus a market correction will be actioned.

Market corrections will only last a matter of days, or weeks at a time so they are entirely different from a ‘market crash’ which can last for months.

Dips in a crypto trend are usually initiated by traders panic selling off the back of negative economic or financial news. Bitcoin saw massive highs in 2017.

However, in early 2018 the digit coin had dropped by over 60%, which saw the cryptocurrency market lose over $300 billion in value. This was most definitely a market crash.

Market corrections create a temporary price pause, for want of a better phrase, to rebalance the market’s supply and demand.

Let’s give you an example of a crypto market correction:

- Let’s say that ETH/BTC has been on an upward trajectory for the last few weeks

- The crypto pair has risen by a steep 40% in that time

- This sharp upward trend can’t continue at that speed

- Crypto investors begin to cash in their gains on the pair

- This causes the trend to change course

As we said, the ETH/BTC trend changed course because treaders started to sell the pair. This means, as per the nature of supply and demand - there are more people selling the crypto-asset than there are buying it in this instance. In doing so, this has a negative impact on the price of the pair.

Don’t be mistaken in thinking that the market correction signifies the downfall of ETH/BTC for good. As we said, it is only a temporary fix to restore the state of equilibrium in the demand and supply of the asset.

Swing Trade Crypto

Swing trading is super popular amongst US crypto traders, especially newbies. This is largely due to a more manageable timeframe. This type of trading involves focusing on the short-term trends of a crypto pair with the hope of making small but frequent profits.

These positions only tend to be kept open for a few trading days, or perhaps a couple of weeks. By studying the cryptocurrency markets analyzing charts, you will be in a better position to make decisions based on facts. Consequently knowing when you should buy or sell.

Let’s give you an example of how swing trading works:

- Imagine you are trading ETH/USD

- After studying the markets you have a feeling the pair will go into oversold territory

- You place a sell order to catch the market correction in time

- Next, you place another sell order to make the most of the downward trajectory

On the contrary, had ETH/USD carried on with an upward trend, you would simply hold onto your position and ride on the coattails of the trend for as long as you can.

Use Technical Analysis Alongside Tools

Learning to understand technical analysis can take years to master. This is because you will need to have a firm grasp of how to read price action via advanced charts. By looking at historical data, you will be looking out for trends.

These trends will often influence the future direction of a currency pair. This is no different from forex trading, whereby technical analysis sits at the core of making consistent, long-term profits.

With that in mind, please find a list of the most useful technical indicators which you can use when trading cryptocurrency in the USA.

Relative Strength Index (RSI):

The RSI measures the enormity of price shifts as well as the velocity of those shifts - great for identifying overbought or oversold cryptocurrencies

Aroon Oscillator:

This indicator follows trends using ‘Aroon Up’ and ‘Aroon Down’ to speculate the robustness of a trend and how likely it is to continue

Directional Movement Index (DMI):

The DMI contains 3 indicators in one and shows traders crypto price trends. This one is going to help you decide whether to go short, long or stay right as you are.

Stochastics Oscillator:

The stochastics oscillator is another indicator which follows crypto trading momentum and its pace. Stochastic oscillators are commonly used to spot oversold and overbought markets

Bollinger Bands Indicator:

Bollinger bands operate as oscillator measures - showing traders whether the market is low in volatility, or high. This is going to give you more of an idea of when to exit and enter a trade.

Moving Averages Indicator (MA):

This one is classed as a ‘lagging indicator’ meaning it is centred on historical price actions. The idea is to level out price action over a specific timeframe.

On Balance Volume (OBV):

The OBV utilises a running total of a crypto-asset’s volume, in order to speculate on shifts in the underlying asset. This offers traders some insight into whether volume is flowing out or in of the pair in question

As you can see there is an indicator and tool for everything. At the forefront of this are moving averages, which are used by most cryptocurrency traders in the USA. They are great for cutting out the noise of extreme price shifts in order to disclose trends - therefore will help you in predicting a crypto pair’s price direction.

The relative strength index is also a hugely popular tool amongst crypto traders and is one of the easiest to use. Any of the above-mentioned tools are a helpful addition to any crypto trading strategy. Most importantly, don’t be afraid to use a variety of indicators at once.

There are heaps of helpful indicators and tools, and by conducting some research you will no doubt have a clearer idea of what you want to use yourself.

Top Crypto Tools

There are heaps of cryptocurrency trading tools used by traders in the USA, and beyond. Please find below some of the most commonly used software and tools utilized today - by cryptocurrency traders of all skill levels.

There are tonnes, so we’ve just listed what we consider to be the cream of the crop below:

- Best market data portals: Coinmarketcap, CryptoMood, CoinGecko, OnchainFX, CoinCodex, CryptoCompare

- Most useful crypto calendars: Kryptocal, CoinMarketCal, ICO Drops, Cointelligence, Coinscalendar, Coindar

- Crypto tax software platforms: Cointracking, Koinly, Blox, TokenTax, Accointing, CryptoTrader.Tax, ZenLedger,

- Leading crypto charting tools: TradingView, Cryptowatch, Coinigy, GoCharting

- Top crypto portfolio rebalancing tools: Shrimpy, 3Commas, Holderlab

- Cryptocurrency monitoring sites: BitcoinVisuals, Blockonomics, Simpleledger.info, Coin Dance, CryptoMiso, Charts.Bitcoin.com, Blockchair,

- Best crypto price trackers: Blockfolio, Coin360, Cointracking, Blox, Coinmarketcap, CryptoCompare, Coinigy, Investing.com

- Top blockchain explorers: OXT (open exploration tool), Sochain, Blockchain.com, Blocktrail, Etherscan, Blockchain.info, Blockcypher, Insight

- Leading crypto research platforms: Mosaic, Crypto Research Report, Bitmex Research, Blockfyre, BBOD

- Best news aggregators: Crypto News, CryptoPanic, Flipboard, Coinjoy, Ccowl, CoinLive, FAWS, CryptoGoat, CoinSpectator, Coinna, Algory, CoinTelegraph, CoinDesk, CryptoCoin

- Notable FREE research resources: BLOCKDATA, Amun AG, Binance, Binance Research, Circle Research, Crypto Research Report, CryptoBriefing

As we’ve said, that’s just our pick of the best. As you go through the process and try out different sources, you will naturally figure out which work best for you and your cryptocurrency trading goals.

Granted, we have mentioned analysis a few times already, but it is with good reason. Without it, you are going to be in the dark about the cryptocurrency market sentiment - therefore speculating on the value of a crypto pair is going to be virtually impossible.

As such, while the above cryptocurrency trading tools can help you with your investment endeavours to the next level, they are no replacement for technical analysis.

Cryptocurrency Trading USA: The Pros and Cons

Should you be still on the fence about whether or not trading this financial asset is for you - it’s time to talk about the positives and negatives of cryptocurrency trading in the USA.

Pros

We’ve already covered quite a lot with regards to trading this asset, but nonetheless, let’s start with the positives

✅ Choice to Buy and Sell

As we showed you in our earlier examples of going long and short on digital currencies - this means you are able to profit whether the pair rises or falls in value.

Of course, you must first correctly predict the direction of the asset. This is where the aforementioned charts, tools and indicators can be your saving grace. If you are going to speculate, it makes sense to at least have a go based on facts and figures.

To clarify - if you think the price of the crypto-asset is going to rise you should go long. If, on the other hand, you think the price of the pair will fall - you need to go short.

✅ Optional Short and Long-Term Trading

Cryptocurrencies can be traded on a long-term basis, as well as in the short-term. By trading cryptocurrencies on a long-term basis you are essentially investing in the asset, as opposed to trading it.

This means you are accessing the crypto coin on a direct basis and could hold onto your digital asset for years at a time.

This is in complete contrast to the aforementioned swing and day trading we told you about earlier. This short-term approach to cryptocurrency trading will see you target much smaller margins. But, at the same time, you will be actively trading - meaning that you might enter dozens of positions each and every week.

✅ Cryptocurrency Trading Around the Clock

The bulk of traditional stock exchange markets operate 9-5 for five days a week. Cryptocurrency exchanges are open 24 hours a day, 7 days a week - although liquidity can differ, this is usually down to the time of the trading day.

Nevertheless, this ensures that you can trade cryptocurrencies in the USA no matter what timezone you wish to operate on.

The Cons

They say not all that glitters is gold. In other words, where there are pros there are probably a few cons too.

Now that we’ve covered the positives of cryptocurrency trading in the USA - in the name of balance, we are going to discuss some of the negatives.

❌ Cryptocurrencies are Unregulated Assets

At this time, cryptocurrencies fall beyond the scope of authoritative regulation. By this, we mean that due to the fact crypto-assets are not printed or controlled by governments - they are not classed as ‘legal tender’.

The value of digital currencies is simply dictated by supply and demand - rather than any monetary authority, like the money we are used to paying our taxes with.

❌ The Cryptocurrency Market can be Highly Volatile

It’s no secret that currency markets can be highly volatile. But, some digital currencies can shift by double-digits in a single trading day. In rarer cases, it is not impossible for a digital currency to increase by triple-digits in less than 24 hours of trading.

This is why we can’t stress enough the value of using orders like take-profit and stop-loss orders. They are great for providing a level of risk management, as well as locking in those gains.

Utilising these orders means you are able to take your eye off the market, knowing full-well that your broker knows your position - and importantly, exactly when to execute the order.

This high-risk environment isn’t something to be fearful of. Much like in the case of forex trading, many crypto traders enjoy that aspect of trading this particular market. After all, the bigger the risk with this speculative asset - the bigger your gains could potentially be.

Cryptocurrency Trading USA: Broker Fees to Expect

When you are on the lookout for a decent broker to carry out your cryptocurrency trades - you will need to be aware of expected fees and what they mean. At the end of the day, brokers are a business - and the only way businesses can continue to provide a service is by making money.

Every USA cryptocurrency trading platform is going to stipulate different fees. So, to give you an idea of what to expect, we’ve listed the most commonly seen fees in the online crypto trading space.

Crypto-Asset Spreads

No matter which asset is being traded, a ‘spread’ will be factored in. For those unaware, the spread in this instance is the contrast between the buy price of the crypto pair with that of its sell price.

The spread is an important factor that should not be understated. For example, if your crypto pair has a spread of say 1%, you need to make 1% on your trade just to break even. This is because you are starting the trade 1% ‘in the red’.

We have put together a simple example of a cryptocurrency trading spread to show you how it works:

- You are trading Ethereum against the US dollar

- The buy price of ETH/USD is $370.50

- The sell price of the pair is $375.00

- The spread on this crypto pair is 1.21%

As you can see, in our example, you would need to make gains of 1.21% on ETH/USD before breaking even on your trade. Anything over 1.21% you could consider as actual profit from this trade.

Broker Trading Fees

Trading fees charged by cryptocurrency brokers vary a great deal. Some trading platforms offer clients completely commission-free trading. At the other end of the scale, brokers might charge a fee per trade, like a $10 fixed fee.

With that said, the vast majority of cryptocurrency trading USA platforms charge a percentage fee that is multiplied against your stake.

Let’s give you an example of how this kind of commission could affect your profits:

- You are trading BTC/USD

- You place a $2,000 stake on the pair

- The trading platform charges 1.5% commission = $30

- You elect to close your BTC/USD trade

- At this time your trade is worth $2,380

- Your broker charges another 1.5% for exiting the trade = $35.70

- You have paid $65.70 in commission alone for opening and closing this position

It is important to note that finding a commission-free broker doesn’t mean you can trade completely for free. Platforms offering zero commission often make up for that in the spread or other hidden fees. Whilst that is certainly not always the case - it is something to watch out for.

Account Inactivity Fees

No two brokers are the same, so we can’t say for sure that you will need to pay an inactivity fee. However, inactivity fees are definitely another one to look out for.

Some trading platforms charge clients who haven’t used their account to actively trade for a specified amount of time. For instance, you might find that after 3 months of inactivity a monthly fee kicks in. Some brokers might start charging say $10 per month - but only after a whole year of not actively using your account to trade.

It is always sensible to check the fee table, as well as terms and conditions, of any company you are handing money over to. Brokers are no different. Life is unpredictable enough, without surprise monthly fees.

Deposit/Withdrawal Fees

Whilst many brokers provide deposit and withdrawals free of charge, others might charge a small fee. This fee can depend on many factors such as the amount you are requesting to withdraw (there might be a charge below a certain amount).

It could also depend on the payment type you are using, or what currency you are paying with (exchange fees). The fee is usually a small one regardless, but it is something to consider. Remember all fees affect your overall crypto trading gains.

Cryptocurrency Trading USA: Signals and Software

As you have no doubt realised by now, cryptocurrency trading in the USA can take a while to master. After all, with all of the tools and charts you need to wrap your head around, this can take time.

If you are keen to get started, you could think about using crypto trading signals and software. These tools are utilized by newbie traders who don’t know how to perform technical analysis. They are also used by traders at all levels who lack the time to follow the markets.

In this section of our Cryptocurrency Trading USA Guide, we are going to talk about robots, signals and third-party trading platform MT4 (which is packed with beneficial tools).

Cryptocurrency Trading Robots

To save any confusion, let’s start by saying that cryptocurrency trading robots are sometimes called ‘automated trading systems’, or ‘EAs’ (expert advisors).

Crypto trading robots allow you to trade digital currencies passively, using pre-programmed signals and algorithms. This means that the downloadable software is able to buy and sell on your behalf.

Here is a quick rundown of the benefits of using a robot to do your crypto bidding for you:

- Scans the relevant markets 24 hours a day, 7 days a week

- Lacks the psychological element of trading - greed and fear

- No need to learn how to read charts

This sounds amazing, right?

You need to be aware that there are heaps of sketchy providers promising EAs which are going to make you richer than Scrooge McDuck overnight. Of course, a lot of these claims are unfounded and unproven. Always tread with caution and where possible try a free demo first.

Cryptocurrency Trading Signals

Signals are similar to crypto trading robots - in the sense that they scour the market and offer a passive way of trading. However, unlike in the case of EAs, signals do not execute the orders without your say so.

These signals send traders an indication of when to grab trading opportunities. Put simply, you will receive signals based on your chosen asset. Signals include whether to buy or sell and when. Suggestions should also include limit-order, stop-loss and take profit levels.

Essentially, signals are like tips - it’s your call whether or not you act on them and place an order.

Cryptocurrency Trading via MT4

MetaTrader4 (MT4) is a big crowd-pleaser in the USA cryptocurrency trading space. It is jam-packed with practical tools, analysis, and charts. The third-party trading platform has a super user-friendly app and is compatible with crypto EAs too.

Please find below a step by step guide on how to get started with a crypto trading robot via MT4:

- Find a well respected EA provider and sign up

- Pay the required amount for your robot software

- Check your email and follow the link to download your new EA

- Find an MT4 compatible broker

- Download MT4 and sign in using your broker info

- Open MT4 and add your robot to the platform

- Give the software the go-ahead to trade automatically for you

With that said, not all cryptocurrency brokers are compatible with MT4. So, if it sounds like something you are interested in you should check first before signing up.

Cryptocurrency Trading USA: Trading Tips

Whilst there is no easy way to make money when trading cryptocurrency in the USA, by reading guides like ours, creating your own strategy and learning the ropes - you’ll be a pro in no time.

With that in mind, we have compiled a list of four helpful tips to consider when planning your next crypto trade.

Crypto Trading Tip 1 - Use a Licenced Broker

In 2015, the CFTC (Commodity Futures Trading Commission) ruled that cryptocurrencies can be classed as and regulated in the same way as commodities. By using a broker holding a CFTC licence, you know that you are dealing with a legitimate company.

In order to gain a licence from regulatory bodies, brokers must keep your funds in a separate bank account to that of the company. They must also adhere to strict rules set out by the regulatory body when it comes to customer care.

There are hundreds of trading platforms offering cryptocurrency trading in the US. But, by only handing your trading funds over to a CFTC broker, you are protecting yourself against the dangers of financial crime and shady brokers in the space.

Crypto trading Tip 2 - Learn the Ins and Outs of the Crypto Market

We realise this sounds a little obvious, but like with any new venture in life, conducting some research is going to make the process run a little more smoothly.

Many new traders in the USA make the mistake of thinking they will be able to learn as they go along. And whilst that might be the case - it could end up being a costly lesson on ‘what not to do’.

There are heaps of cryptocurrency specific courses you can take online, not to mention the plethora of helpful educational tools and books available on the subject.

On the Trading Education website, you will find a good variety of courses on cryptocurrency trading, as well as useful strategies, tips on understanding technical analysis - and more!

Crypto trading Tip 3 - Understand Charts and Analysis

As we’ve covered, there are tonnes of technical indicators, different price charts and fundamental research tools in existence to help traders predict the market.

Unless you plan on trading in a passive way using cryptocurrency robots - by not gaining a basic understanding of crypto-relevant charts you would be doing yourself an injustice.

Digital coin traders from all over the world use the many tools available - mainly to aid in their decision making. Which in turn, helps them better manage their trading funds.

Utilizing a buy and hold strategy allows you to hold onto your cryptocurrencies for months, or even years. This also means that you no longer need to concern yourself with short-term trends in terms of price action.

In spite of this, many experienced traders do not opt to keep positions open for that length of time, with many only holding crypto assets for a few days, hours, or even minutes!

Irrelevant of the strategy you end up using yourself, understanding charts and analysis in relation to your asset of choice is only going to help you in the future.

Crypto trading Tip 4 - Try a Demo Account

Demo accounts are not reserved just for newbie traders - albeit they offer a superb way to learn the crypto trading ropes. We should mention that not all brokers offer a demo account, so do look into this before signing up if it is something you are interested in.

In a nutshell, many free demo accounts give you a specific amount of ‘paper money’, meaning demo funds to trade with. When trading digital coins on a demo account you will be trading in a real-life market environment.

This is another reason why demos are handy for seasoned and new traders alike. What better way to try out a new strategy than to try it out without risking your own capital?

Cryptocurrency Trading USA: How to Sign Up With a Broker

The majority of online brokers are going to make it super easy for you to sign up. With that in mind, we have compiled a simple walkthrough to give you an idea of what to expect.

Step 1: Register With a Trading Platform

Once you have decided which broker you want to use you can head over to the website and click ‘sign up’.

Next, you will need to enter your first and last name, home address, email and telephone number.

If you are using a regulated trading platform that accepts fiat money deposits (like a debit card or bank transfer), you will also need to upload some photo ID to prove who you are. This is largely to avoid money laundering and fraud etc.

Step 2: Fund Your Trading Account

When you have finished signing up, which usually takes less than a couple of minutes - you are going to need to deposit funds into your new trading account.

If using a platform that supports fiat currency, then you might get to choose from a debit card, e-wallet, or bank wire.

The majority of broker websites will stipulate a minimum amount of which you must fund your account with. This doesn’t mean that you have to necessarily trade with that full amount.

In a lot of cases, cryptocurrency trading platforms will only support deposits and withdrawals in the form of digital currencies. This means that you will need to transfer the likes of Bitcoin or Ethereum from your private wallet.

Step 3: Decide Which Pair to Trade

Now that you have opened yourself a trading account, and deposited the minimum amount required - you need to choose a cryptocurrency pair to trade.

You should find a comprehensive search facility on the trading platform. Here you should be able to find the categories we talked about earlier.

Most good brokers offer a wide selection of crypto-to-crypto pairs and crypto-to-fiat pairs. However, it’s always a good idea to check pair availability on the platform before actually signing up. This is especially the case if there is a specific crypto pair you want to trade.

Step 4: Place Your First Crypto-Asset Order

Finally, assuming you now have a clear idea of which pair you would like to trade - you can go ahead and place your very first order.

Remember, your goal is to correctly speculate on whether the value of the asset is going to rise or fall. Therefore, you’ll need to place a buy or sell order accordingly.

It’s also highly recommended that you utilise a stop-loss and take-profit order to manage the risk-reward of the trade.

Cryptocurrency Trading USA: Final Thoughts

There are well over 6,000 cryptocurrencies in existence. However, the digital assets holding any real significance on the market is probably less than 20.

We think that crypto-to-fiat pairs are most suited to newbie traders. The most popular crypto pair to trade is Bitcoin against the US dollar (BTC/USD). You will find this and other crypto-to-fiat pairs on offer via most trading platforms.

Whether you decide to trade using cryptocurrency signals or not - it’s a good idea to get to grips with the market and try to learn how to use even the basic charts and analysis tools available at your fingertips.

All of these cryptocurrency trading tools are going to help you when it comes to making decisions - there’s no other way to gain a better understanding of market sentiment.

Trying a demo account is a superb way of learning the cryptocurrency trading ropes, and best of all - it’s free. Not all USA cryptocurrency brokers offer demos though, so if that is something you might want to use before risking your real money - make sure you check before going through the sign up procedure.

FAQs

- Can I trade cryptocurrencies in the USA?

Yes, you can indeed trade cryptocurrencies in the US. All you need to do is find a good broker! Some trading platforms offer free demo trading accounts to use whilst you find your feet.

- How can I tell if a broker is genuine?

The best way to see whether a brokerage firm is above board is to only sign up with a licensed and regulated trading platform.

- Will I be offered leverage trading crypto-assets in the US?

No. The reason being that CFDs are not offered to retail traders in the US. However, some unregulated brokers might offer up to 1:100 leverage on cryptocurrencies. Be careful with such platforms as you will have nowhere to turn if the broker is illegitimate.

- Can I practice cryptocurrency trading in the USA?

Yes, sure. If your trading platform offers clients a demo account (which many do). In this case, you will be able to trade cryptocurrencies using paper money (demo funds), while at the same time mirroring real-life market conditions.

- Which Cryptocurrency pair do most people trade in the USA?

The most traded cryptocurrency pair in the USA and on the planet is Bitcoin against the US dollar - shown as BTC/USD

eToro USA LLC; Investments are subject to market risk, including the possible loss of principal. Virtual currencies are highly volatile. Your capital is at risk.